Home Office Tax Deduction Germany 2022 . Read on to find out what expenses for your home office you can deduct from tax. Home office tax deductions in germany. The federal government has now agreed that the scheme will be extended into 2022, meaning that employees can deduct five. With the “home office lump sum” credit, you can claim €6 for every day you work from home — for a maximum of 210 days for. Managing your taxes as a freelancer in germany. You may have heard that germany lets you deduct the costs of running a home office if you work from home. If, for specific tasks, you permanently do not have access to a workstation in your company, you can still claim the lump. Can i deduct my home office? What about my power and internet bill? Since 2020, you can claim your home office in your tax returns even if it doesn’t have a dedicated space, thanks to the home office.

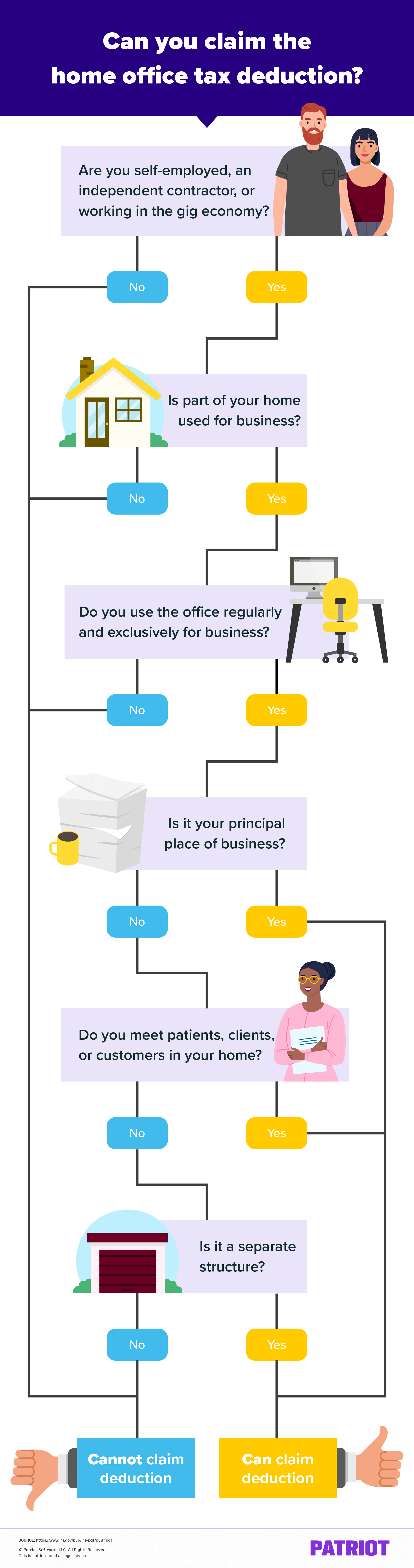

from www.patriotsoftware.com

Managing your taxes as a freelancer in germany. If, for specific tasks, you permanently do not have access to a workstation in your company, you can still claim the lump. You may have heard that germany lets you deduct the costs of running a home office if you work from home. Read on to find out what expenses for your home office you can deduct from tax. Home office tax deductions in germany. With the “home office lump sum” credit, you can claim €6 for every day you work from home — for a maximum of 210 days for. Since 2020, you can claim your home office in your tax returns even if it doesn’t have a dedicated space, thanks to the home office. Can i deduct my home office? What about my power and internet bill? The federal government has now agreed that the scheme will be extended into 2022, meaning that employees can deduct five.

Home Office Tax Deduction Deduction for Working from Home

Home Office Tax Deduction Germany 2022 With the “home office lump sum” credit, you can claim €6 for every day you work from home — for a maximum of 210 days for. What about my power and internet bill? Home office tax deductions in germany. With the “home office lump sum” credit, you can claim €6 for every day you work from home — for a maximum of 210 days for. If, for specific tasks, you permanently do not have access to a workstation in your company, you can still claim the lump. The federal government has now agreed that the scheme will be extended into 2022, meaning that employees can deduct five. You may have heard that germany lets you deduct the costs of running a home office if you work from home. Can i deduct my home office? Since 2020, you can claim your home office in your tax returns even if it doesn’t have a dedicated space, thanks to the home office. Read on to find out what expenses for your home office you can deduct from tax. Managing your taxes as a freelancer in germany.

From www.forbes.com

How To Deduct Your Home Office On Your Taxes Forbes Advisor Home Office Tax Deduction Germany 2022 Read on to find out what expenses for your home office you can deduct from tax. You may have heard that germany lets you deduct the costs of running a home office if you work from home. Home office tax deductions in germany. Managing your taxes as a freelancer in germany. What about my power and internet bill? If, for. Home Office Tax Deduction Germany 2022.

From www.ipcstore.com

Home Office Tax Deductions for Small Business and Homeowner Home Office Tax Deduction Germany 2022 Home office tax deductions in germany. The federal government has now agreed that the scheme will be extended into 2022, meaning that employees can deduct five. With the “home office lump sum” credit, you can claim €6 for every day you work from home — for a maximum of 210 days for. What about my power and internet bill? If,. Home Office Tax Deduction Germany 2022.

From www.addify.com.au

Home Office Deduction Which Expenses Can You Deduct? Addify Home Office Tax Deduction Germany 2022 If, for specific tasks, you permanently do not have access to a workstation in your company, you can still claim the lump. Can i deduct my home office? You may have heard that germany lets you deduct the costs of running a home office if you work from home. Managing your taxes as a freelancer in germany. Home office tax. Home Office Tax Deduction Germany 2022.

From www.stkittsvilla.com

Home Office Deductions What Expenses Are Deductible Marca Home Office Tax Deduction Germany 2022 If, for specific tasks, you permanently do not have access to a workstation in your company, you can still claim the lump. The federal government has now agreed that the scheme will be extended into 2022, meaning that employees can deduct five. Since 2020, you can claim your home office in your tax returns even if it doesn’t have a. Home Office Tax Deduction Germany 2022.

From www.patriotsoftware.com

Home Office Tax Deduction Deduction for Working from Home Home Office Tax Deduction Germany 2022 If, for specific tasks, you permanently do not have access to a workstation in your company, you can still claim the lump. Since 2020, you can claim your home office in your tax returns even if it doesn’t have a dedicated space, thanks to the home office. Home office tax deductions in germany. Read on to find out what expenses. Home Office Tax Deduction Germany 2022.

From www.stkittsvilla.com

Can You Take A Home Office Tax Deduction Virblife Com Home Office Tax Deduction Germany 2022 Since 2020, you can claim your home office in your tax returns even if it doesn’t have a dedicated space, thanks to the home office. What about my power and internet bill? The federal government has now agreed that the scheme will be extended into 2022, meaning that employees can deduct five. Can i deduct my home office? You may. Home Office Tax Deduction Germany 2022.

From www.pinterest.com

Your Guide to Claiming a Legit Home Office Tax Deduction Tax Home Office Tax Deduction Germany 2022 The federal government has now agreed that the scheme will be extended into 2022, meaning that employees can deduct five. You may have heard that germany lets you deduct the costs of running a home office if you work from home. If, for specific tasks, you permanently do not have access to a workstation in your company, you can still. Home Office Tax Deduction Germany 2022.

From www.stkittsvilla.com

Publication 936 2022 Home Morte Interest Deduction Internal Revenue Service Home Office Tax Deduction Germany 2022 Can i deduct my home office? If, for specific tasks, you permanently do not have access to a workstation in your company, you can still claim the lump. The federal government has now agreed that the scheme will be extended into 2022, meaning that employees can deduct five. What about my power and internet bill? Home office tax deductions in. Home Office Tax Deduction Germany 2022.

From www.balboacapital.com

Home Office Tax Deduction Guide Balboa Capital Home Office Tax Deduction Germany 2022 The federal government has now agreed that the scheme will be extended into 2022, meaning that employees can deduct five. Read on to find out what expenses for your home office you can deduct from tax. You may have heard that germany lets you deduct the costs of running a home office if you work from home. With the “home. Home Office Tax Deduction Germany 2022.

From answerlibraryweizzz.z13.web.core.windows.net

Home Office Tax Deduction Worksheet Home Office Tax Deduction Germany 2022 With the “home office lump sum” credit, you can claim €6 for every day you work from home — for a maximum of 210 days for. The federal government has now agreed that the scheme will be extended into 2022, meaning that employees can deduct five. Managing your taxes as a freelancer in germany. If, for specific tasks, you permanently. Home Office Tax Deduction Germany 2022.

From www.stkittsvilla.com

Home Office Tax Deduction Still Available Just Not For Covid Displaced Home Office Tax Deduction Germany 2022 What about my power and internet bill? Read on to find out what expenses for your home office you can deduct from tax. You may have heard that germany lets you deduct the costs of running a home office if you work from home. With the “home office lump sum” credit, you can claim €6 for every day you work. Home Office Tax Deduction Germany 2022.

From www.stkittsvilla.com

Here Are The Rules For Claiming Home Office Expenses In 2022 Globe And Mail Home Office Tax Deduction Germany 2022 Read on to find out what expenses for your home office you can deduct from tax. What about my power and internet bill? Since 2020, you can claim your home office in your tax returns even if it doesn’t have a dedicated space, thanks to the home office. Home office tax deductions in germany. With the “home office lump sum”. Home Office Tax Deduction Germany 2022.

From boxelderconsulting.com

2023 Tax Bracket Changes and IRS Annual Inflation Adjustments Home Office Tax Deduction Germany 2022 Can i deduct my home office? Managing your taxes as a freelancer in germany. Since 2020, you can claim your home office in your tax returns even if it doesn’t have a dedicated space, thanks to the home office. What about my power and internet bill? If, for specific tasks, you permanently do not have access to a workstation in. Home Office Tax Deduction Germany 2022.

From www.everycrsreport.com

The Home Office Tax Deduction Home Office Tax Deduction Germany 2022 Can i deduct my home office? Managing your taxes as a freelancer in germany. What about my power and internet bill? Since 2020, you can claim your home office in your tax returns even if it doesn’t have a dedicated space, thanks to the home office. You may have heard that germany lets you deduct the costs of running a. Home Office Tax Deduction Germany 2022.

From bodenewasurk.github.io

Work From Home Home Office Tax Deduction Tax Deduction Reform Home Office Tax Deduction Germany 2022 With the “home office lump sum” credit, you can claim €6 for every day you work from home — for a maximum of 210 days for. Home office tax deductions in germany. If, for specific tasks, you permanently do not have access to a workstation in your company, you can still claim the lump. Read on to find out what. Home Office Tax Deduction Germany 2022.

From germanpedia.com

Tax Deductions in Germany [32 Ways To Save Tax in 2024] Home Office Tax Deduction Germany 2022 Read on to find out what expenses for your home office you can deduct from tax. Managing your taxes as a freelancer in germany. Since 2020, you can claim your home office in your tax returns even if it doesn’t have a dedicated space, thanks to the home office. Home office tax deductions in germany. What about my power and. Home Office Tax Deduction Germany 2022.

From www.pinterest.com

Home Office Tax Deduction Eligibility and Benefits Home Office Tax Deduction Germany 2022 Can i deduct my home office? If, for specific tasks, you permanently do not have access to a workstation in your company, you can still claim the lump. Read on to find out what expenses for your home office you can deduct from tax. Home office tax deductions in germany. With the “home office lump sum” credit, you can claim. Home Office Tax Deduction Germany 2022.

From jackiewarren375headline.blogspot.com

Jackie Warren Headline Home Office Expenses Deduction 2022 Home Office Tax Deduction Germany 2022 What about my power and internet bill? If, for specific tasks, you permanently do not have access to a workstation in your company, you can still claim the lump. With the “home office lump sum” credit, you can claim €6 for every day you work from home — for a maximum of 210 days for. Home office tax deductions in. Home Office Tax Deduction Germany 2022.